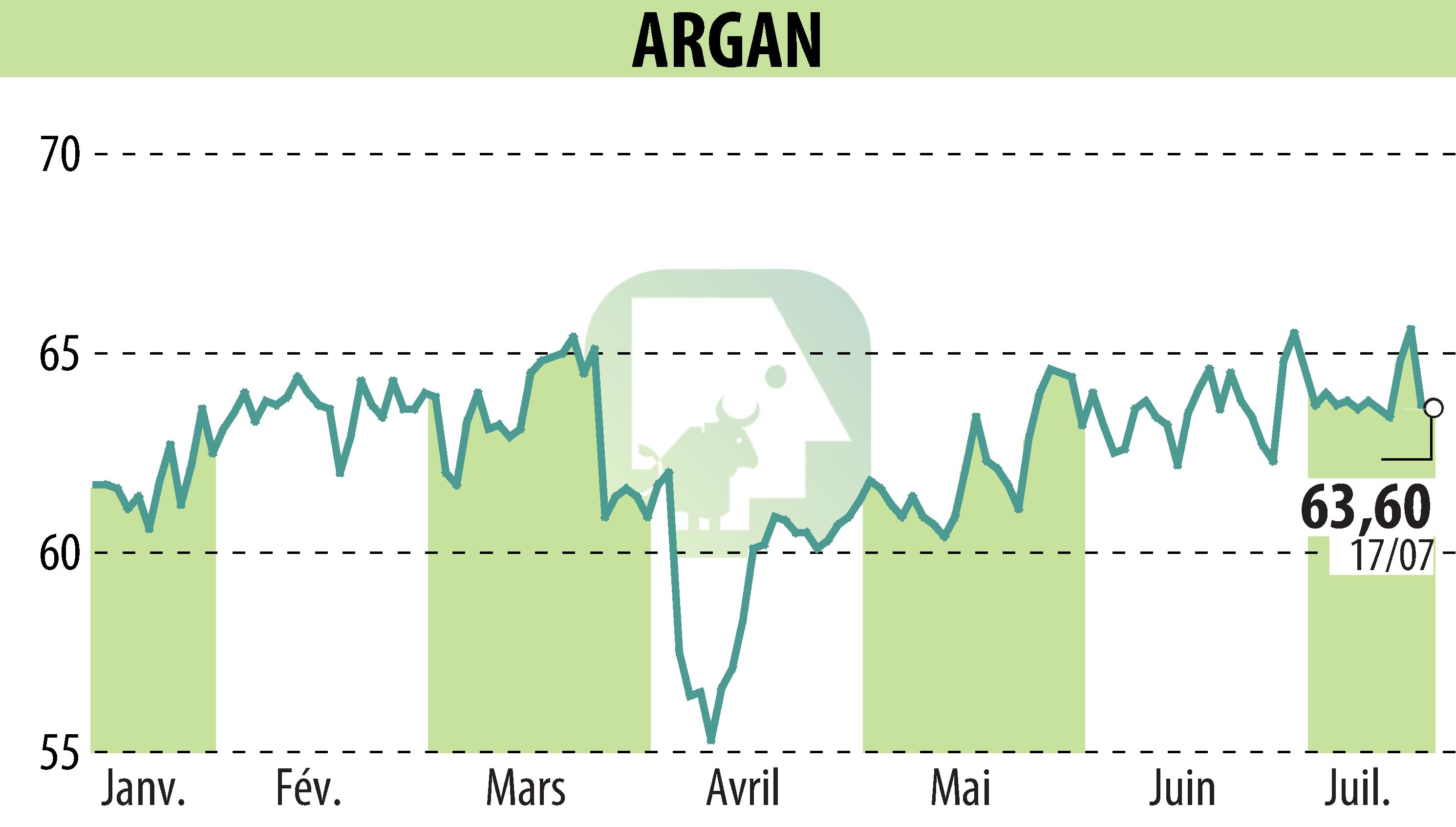

sur ARGAN (EPA:ARG)

ARGAN: Half-Year 2025 Results Highlight Growth and Strategic Advances

ARGAN reported a strong financial performance for the first half of 2025. Rental income rose to €106 million, marking an 8% increase. Recurring net income surged by 16% to reach €78 million. This aligns the company with its targets for 2025, which include a 6% growth in rental income and an 11% rise in recurring net income. Key efforts in debt reduction are evident, with the EPRA LTV ratio reduced to 42% and expected to fall below 40% by year-end.

The company maintains a 100% occupancy rate, reflecting the prime quality of its assets. The portfolio value increased by 3%, reaching €4.02 billion by June 30, 2025. This progress supports ARGAN’s strategy of growth and debt reduction, continuing the roadmap outlined for 2024-2026 with €200 million in planned investments for these years.

Sale initiatives are underway, with a transaction expected to net €130 million by the end of 2025. The company also managed to reduce the cost of debt to 2.10%, underscoring their prudent financial management. These results position ARGAN strongly for its continued roadmap of financial solidity and growth.

R. H.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de ARGAN