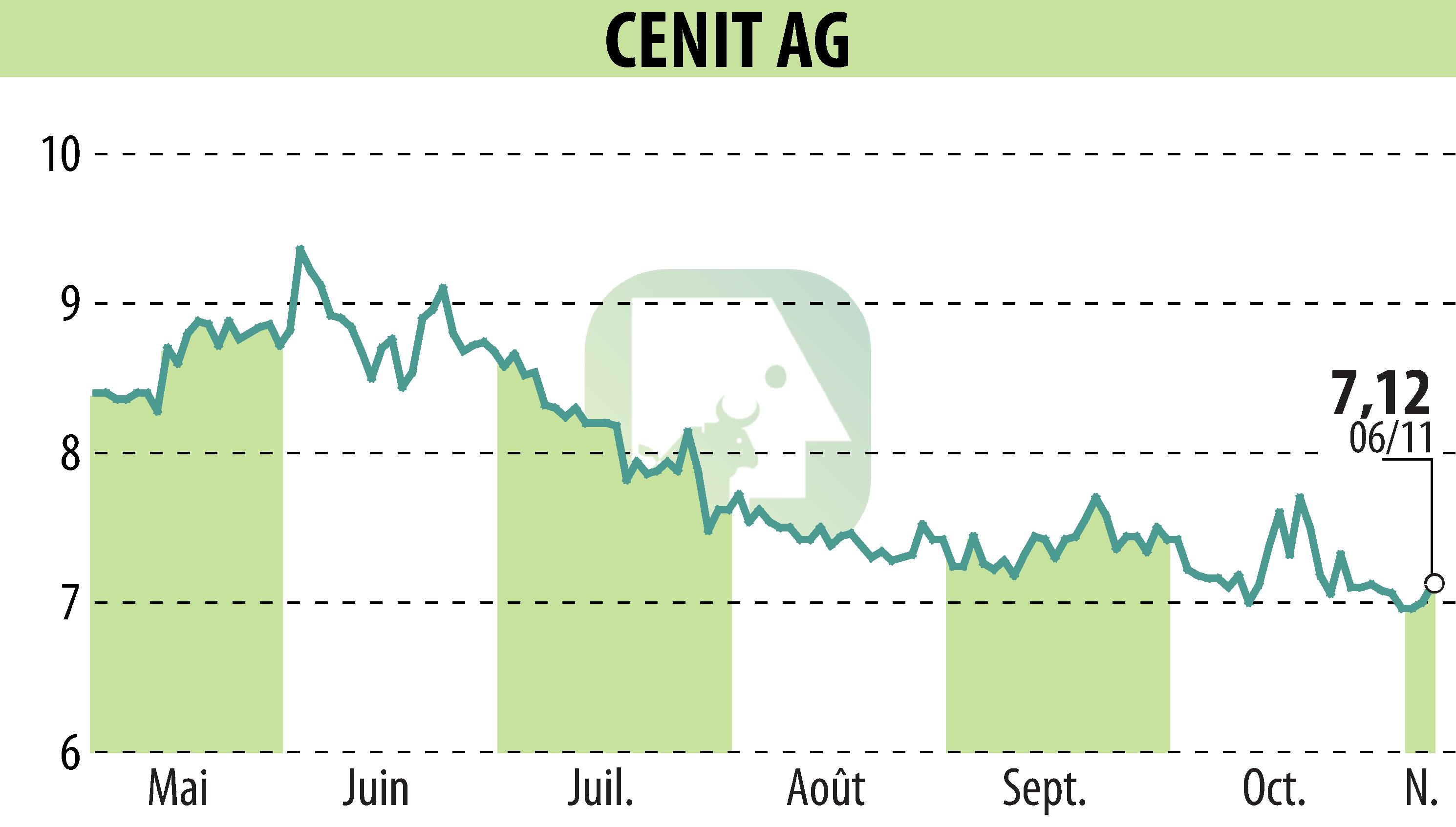

sur CENIT AG (ETR:CSH)

CENIT AG Shows Resilience in Challenging Market

CENIT AG recently reported a modest revenue increase of 1.8% to €154.20 million for the first nine months of 2025. This growth stems largely from the acquisition of Analysis Prime, with this effect limited to the initial half-year period. Adjusted figures indicate a revenue decline of about 2%. The automotive sector, a key market for CENIT, faces ongoing challenges.

Third-party software sales decreased slightly, while proprietary software sales increased. Recurring CENIT software revenues rose to 80.3%. Consulting revenue jumped due to the Analysis Prime acquisition. Despite rising sales, EBIT fell to €-1.50 million due to the 'Project Performance' restructuring costs. Personnel cuts improved financial outcomes in Q3.

No acquisitions are planned in 2025, focusing on liquidity preservation. CENIT's revenue expectations are at least €205 million with a consistent EBIT forecast. The restructuring's completion foresees no further extraordinary expenses. While Q4 revenue may lag behind last year, growth over Q3 is anticipated, maintaining a €16.00 price target.

R. H.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de CENIT AG