sur CREDIT AGRICOLE DE NORMANDIE SEINE (EPA:CCN)

Crédit Agricole Normandie-Seine Half-Year Results as of June 30, 2025

In the first half of 2025, Crédit Agricole Normandie-Seine stood out in an uncertain economic climate. With outstanding loans reaching €17.09 billion, a 0.1% increase year-on-year, the bank remains the leader in its region. Savings, meanwhile, increased by 3%, reaching €22.53 billion.

The number of customers increased by 0.8% to 688,600, thanks to the arrival of 14,400 new customers. At the same time, the insurance portfolio grew by 2%. On the financial front, net banking income increased by €8.9 million. However, the cost of risk also increased, resulting in a net income of €57.3 million, a decline of 4.5%.

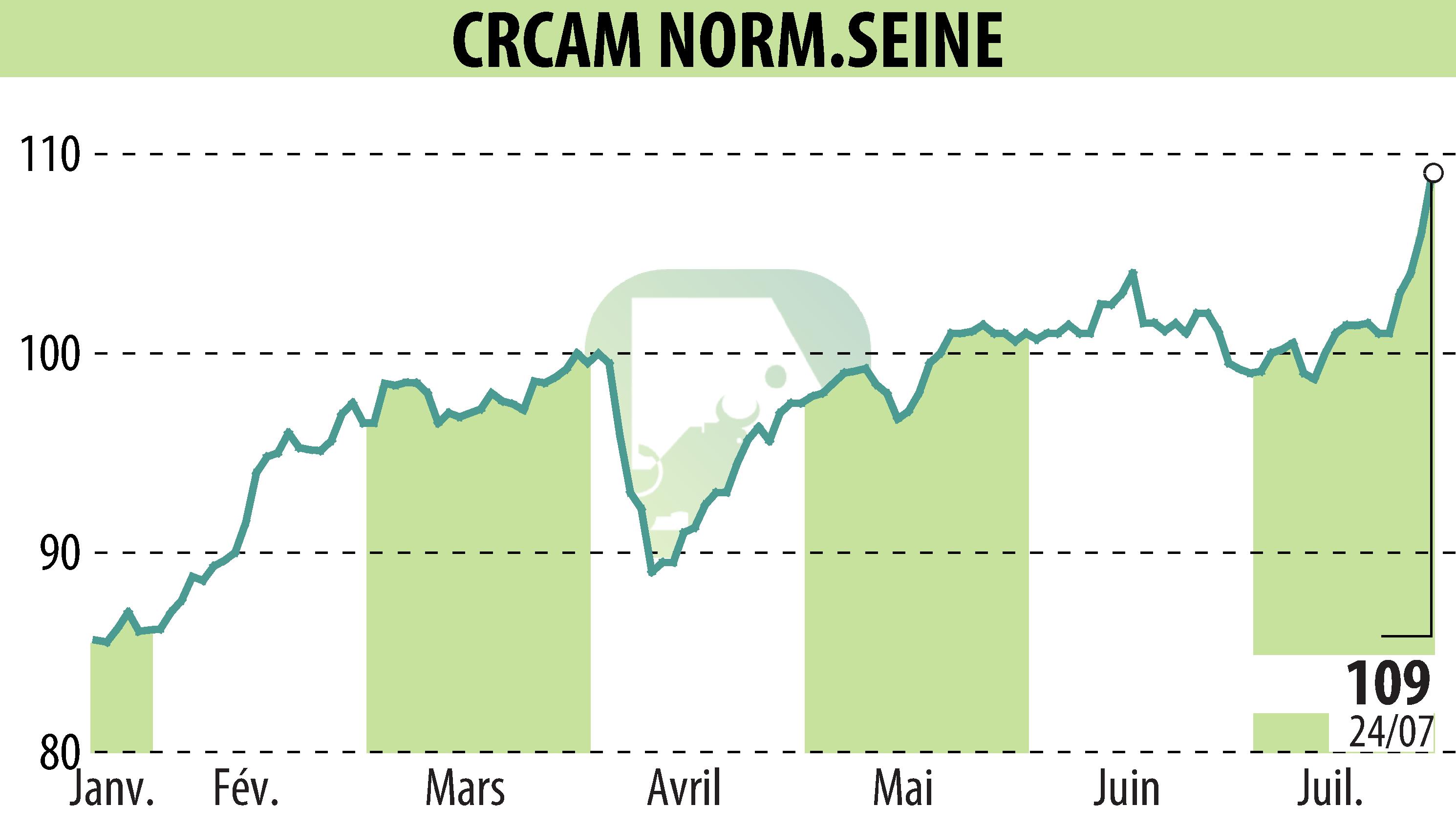

Finally, the CCI share price has slightly decreased by 1.58% since March. The bank nevertheless maintains a liquidity ratio (LCR) of 118.94%, above regulatory requirements.

R. P.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de CREDIT AGRICOLE DE NORMANDIE SEINE