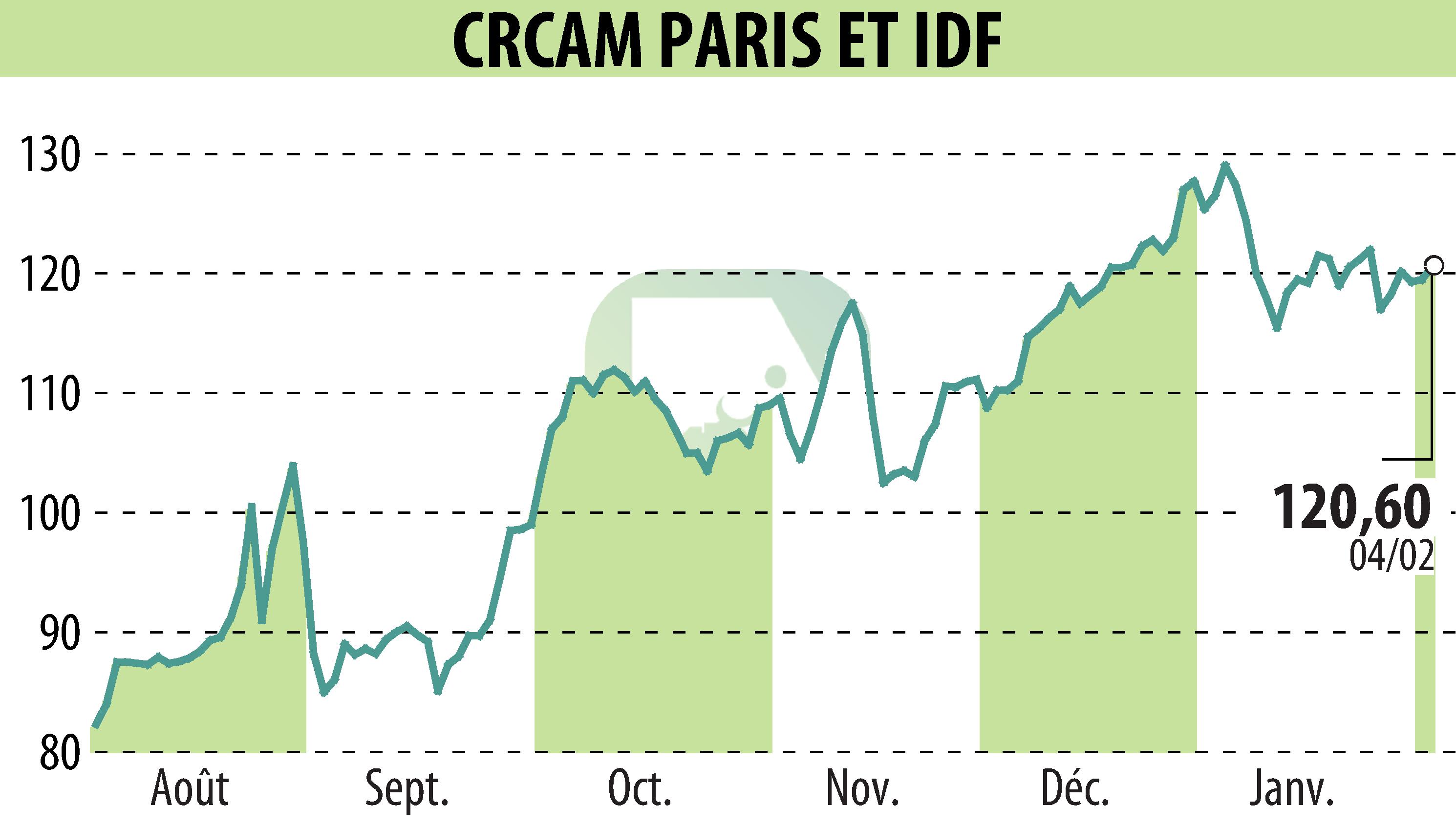

sur CREDIT AGRICOLE ILE DE FRANCE (EPA:CAF)

2025 Financial Results of Crédit Agricole d'Ile-de-France

Crédit Agricole Ile-de-France announces strong growth in its business for 2025, with over €150 billion in outstanding loans entrusted to it by its customers. The number of new customers has increased significantly, driven by improved services and a recovering real estate market.

Net income attributable to the Group increased by 23.1%, reaching €236.2 million. This growth was driven by consolidated net banking income of €1,032.4 million, up 6.8%, and prudent risk cost management.

The bank highlights its significant financial strength, with a CET1 capital ratio of 23.0%, an indicator of stability in the face of economic uncertainties. A stable dividend is offered to holders of Cooperative Investment Certificates.

Finally, various social initiatives and support for startups demonstrate Crédit Agricole d'Ile-de-France's commitment to regional development.

R. H.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de CREDIT AGRICOLE ILE DE FRANCE