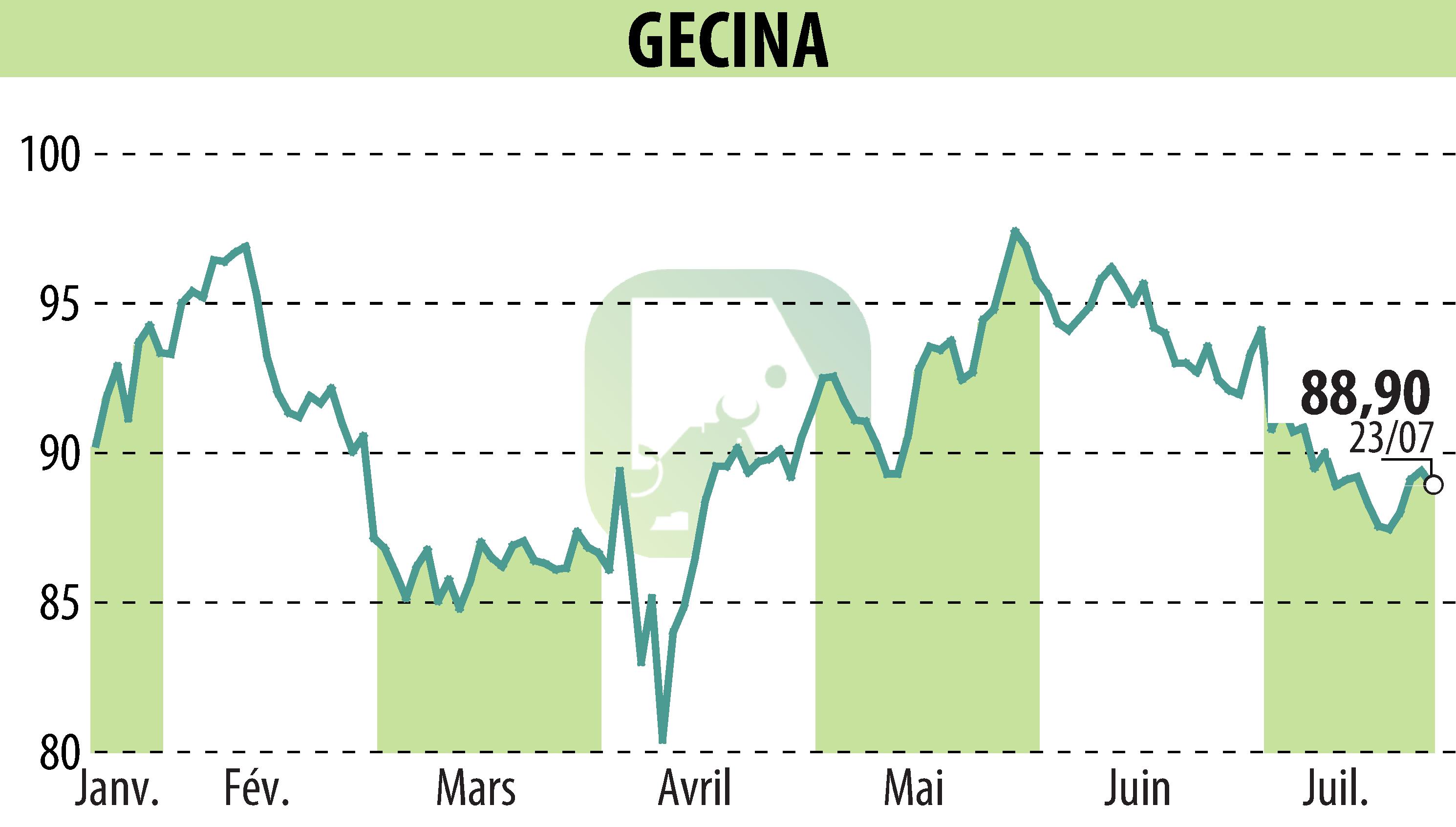

sur GECINA (EPA:GFC)

Gecina launches a buyout offer and a new green bond issue

Gecina announced on July 24, 2025, the launch of a repurchase offer on its bonds maturing in 2027 and 2028. Simultaneously, the company plans a €500 million 10-year green bond issue. This transaction aims to optimize the maturity profile of its debt and strengthen its long-term financial visibility.

The existing bonds in question include €700 million maturing in 2027 and €800 million maturing in 2028, both with a coupon of 1.375%. Priority allocation of the new bonds could be granted to existing holders.

Gecina, rated A-, has €3.7 billion in liquidity and continues to proactively manage its financial structure. The success of the green bond issue will determine the tender offer, in accordance with the terms of the Tender Offer Memorandum published on this date.

R. P.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de GECINA