sur Grand City Properties S.A., (ETR:GYC)

Grand City Properties' Credit Rating Downgrade and Market Outlook

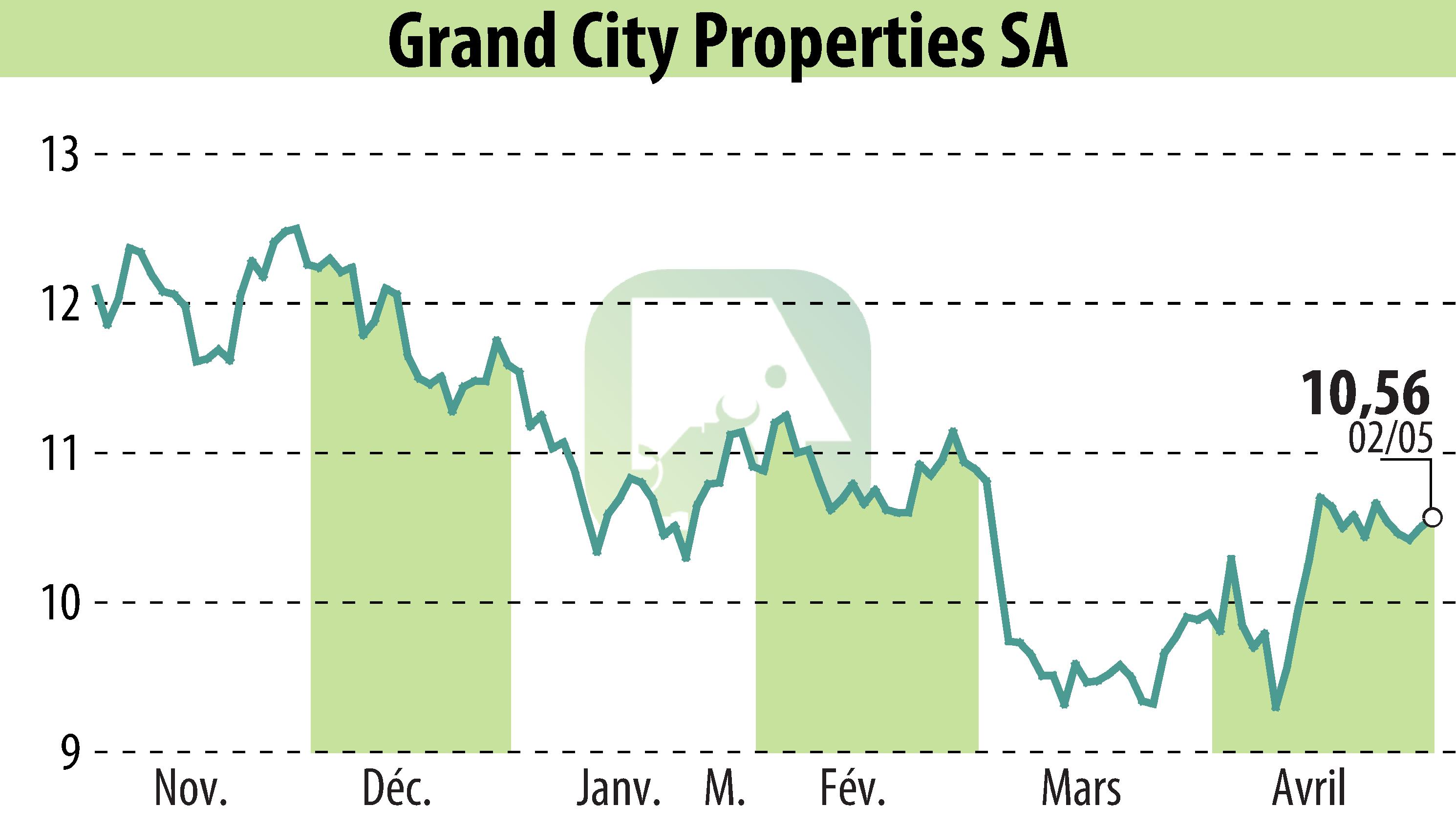

First Berlin Equity Research has reiterated its "Buy" recommendation for Grand City Properties S.A., with a target price of €14.20. This comes after Standard & Poor’s downgraded Grand City's credit rating from BBB+ to BBB, but with a stable outlook. The downgrade aligns with the similar downgrade of Aroundtown, in which Grand City holds a 62% stake. The decision by S&P reflects concerns about the German economy's impact on Aroundtown’s 2025 disposal activities and its leverage compliance.

Despite the downgrade, Grand City’s standalone credit profile remains at BBB+, backed by strong operational performance and positive fundamentals in the residential markets of Germany and London. Notably, Grand City’s bonds showed little reaction, indicating that the market had already anticipated this re-rating. The analyst maintains a positive outlook, pointing to a potential 35% upside in stock value.

R. H.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de Grand City Properties S.A.,