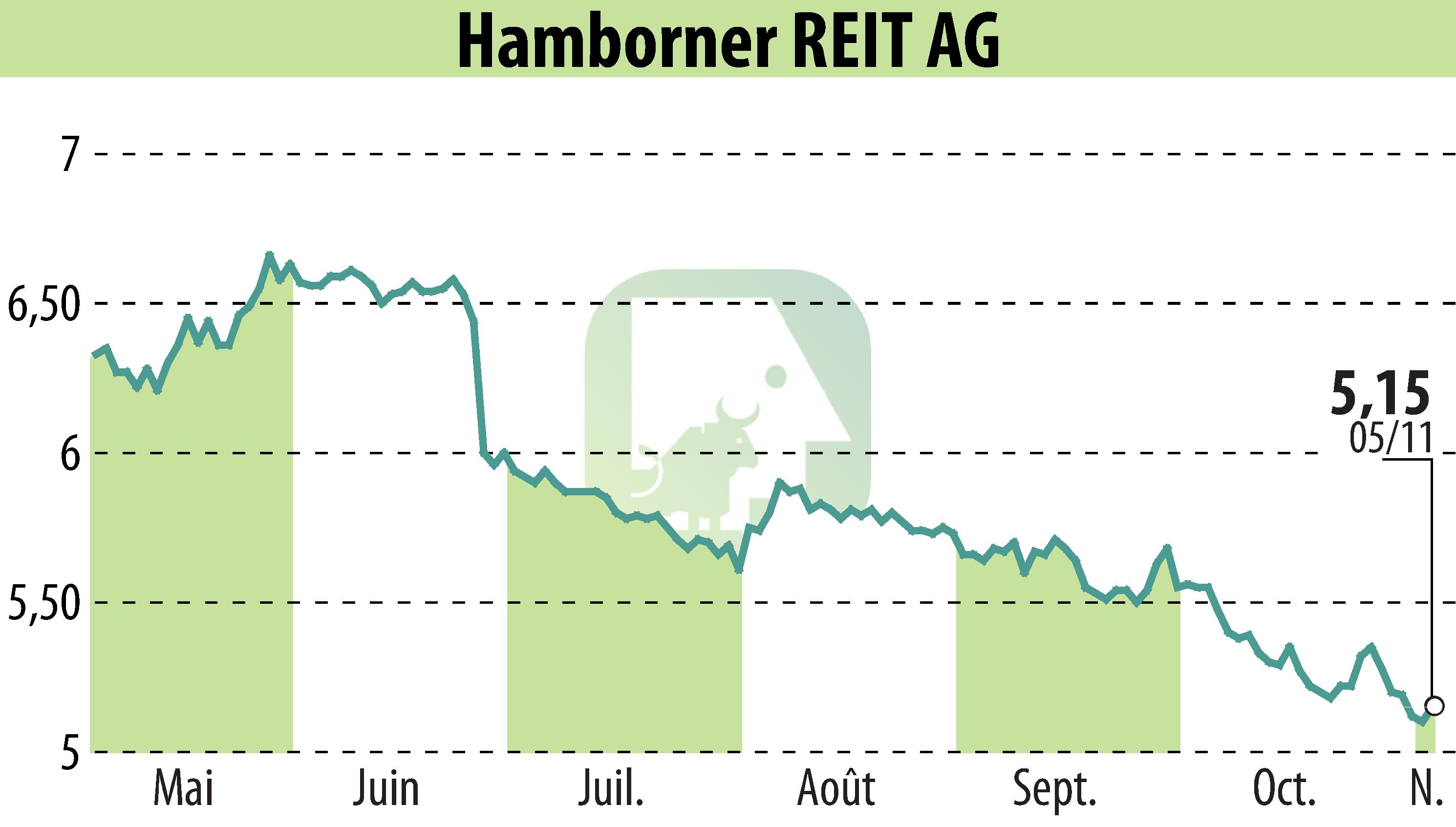

sur HAMBORNER REIT AG (ETR:HABA)

HAMBORNER REIT AG's Third Quarter Results Indicate Planned Business Progress

HAMBORNER REIT AG announced continued business development according to its plan in the third quarter of 2025, despite a challenging environment. Rental income fell by 2.8% to €67.9 million, attributed largely to property disposals. Funds from operations (FFO) also decreased by 12.2% to €36.7 million, affecting the FFO per share which dropped to €0.45.

The company improved its loan-to-value ratio to 43.3%, following a rise earlier due to dividend payments. The net asset value per share decreased slightly to €9.65. No changes occurred in the property portfolio during Q3, maintaining its value at €1,406.3 million.

Leasing activities were steady, with rental agreements covering around 25,000 m², mostly with existing tenants. The weighted average lease term slightly declined to 5.5 years, with the vacancy rate improving to 3.4%.

HAMBORNER reaffirms its 2025 full-year forecast, expecting rental income in the range of €89.5 million to €90.5 million and FFO of €44.0 million to €46.0 million.

R. P.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de HAMBORNER REIT AG