sur INDUS Holding AG (ETR:INH)

INDUS Holding AG: Resilience Amid Challenges

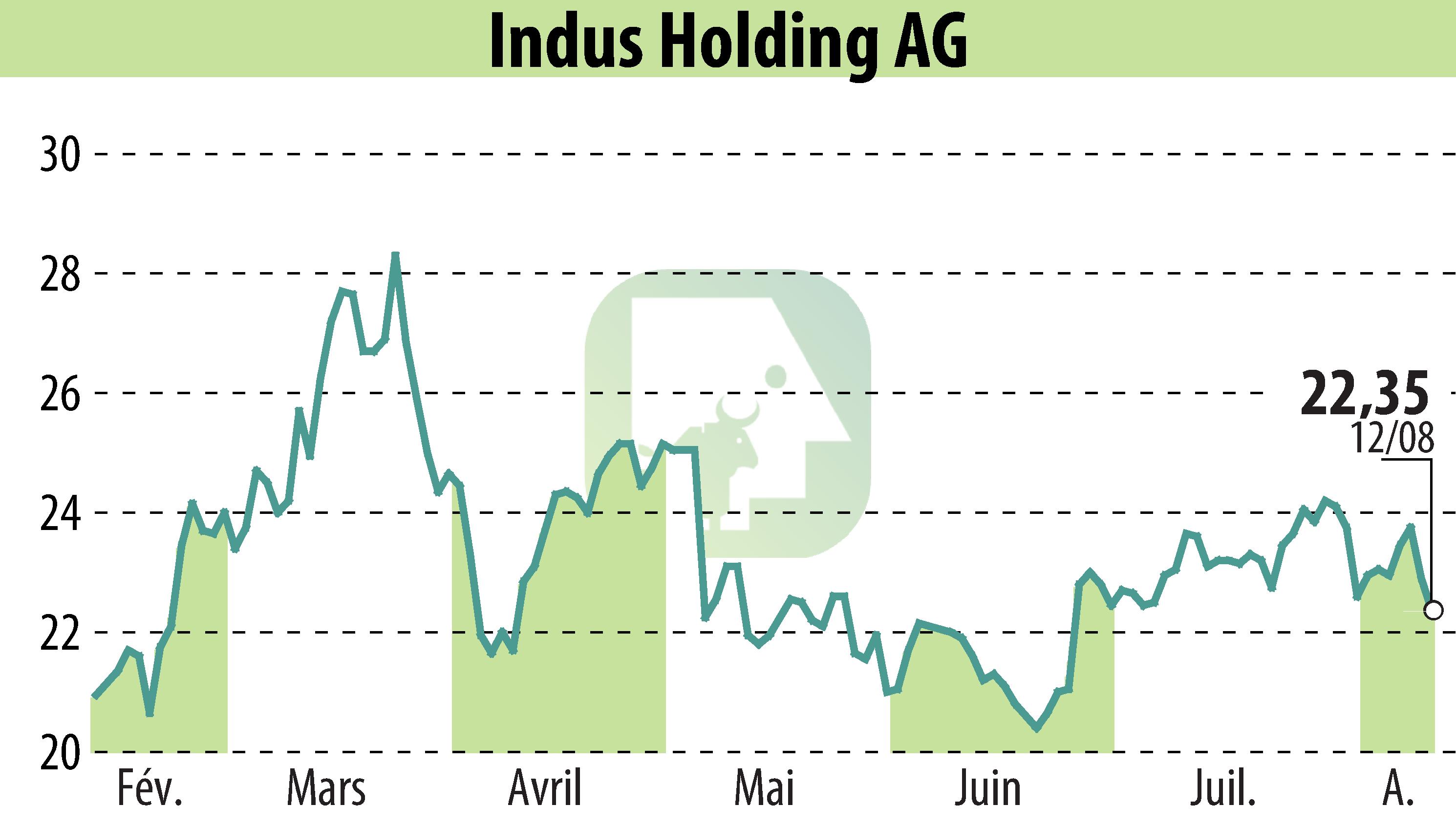

INDUS Holding AG, a German industrial holding company, has been reassessed by NuWays AG, retaining a "BUY" recommendation with a target price of €34. The company's Q2 sales rose to €434 million, reflecting a 1.2% year-over-year growth, primarily driven by a 7.5% increase in the Infrastructure segment, despite supply chain challenges impacting Materials Solutions sales. Notably, the group's order intake surged by 16% year-over-year, showing promise for H2 improvements.

However, adjusted EBITA dropped by 26% to €31.2 million due to the demanding supply chain environment and foreign exchange headwinds. Free cash flow (FCF) was negative in H1, but an optimistic outlook is maintained with a projected FCF exceeding €90 million for FY25.

INDUS’s strategic acquisitions have bolstered its presence, aligning with the "Empowering Mittelstand" strategy. The firm's FY25 guidance remains confident with expected sales between €1.7 billion and €1.85 billion.

R. P.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de INDUS Holding AG