sur Klöckner & Co. SE (ETR:KCO)

Klöckner & Co and Worthington Steel Announce Major Business Combination

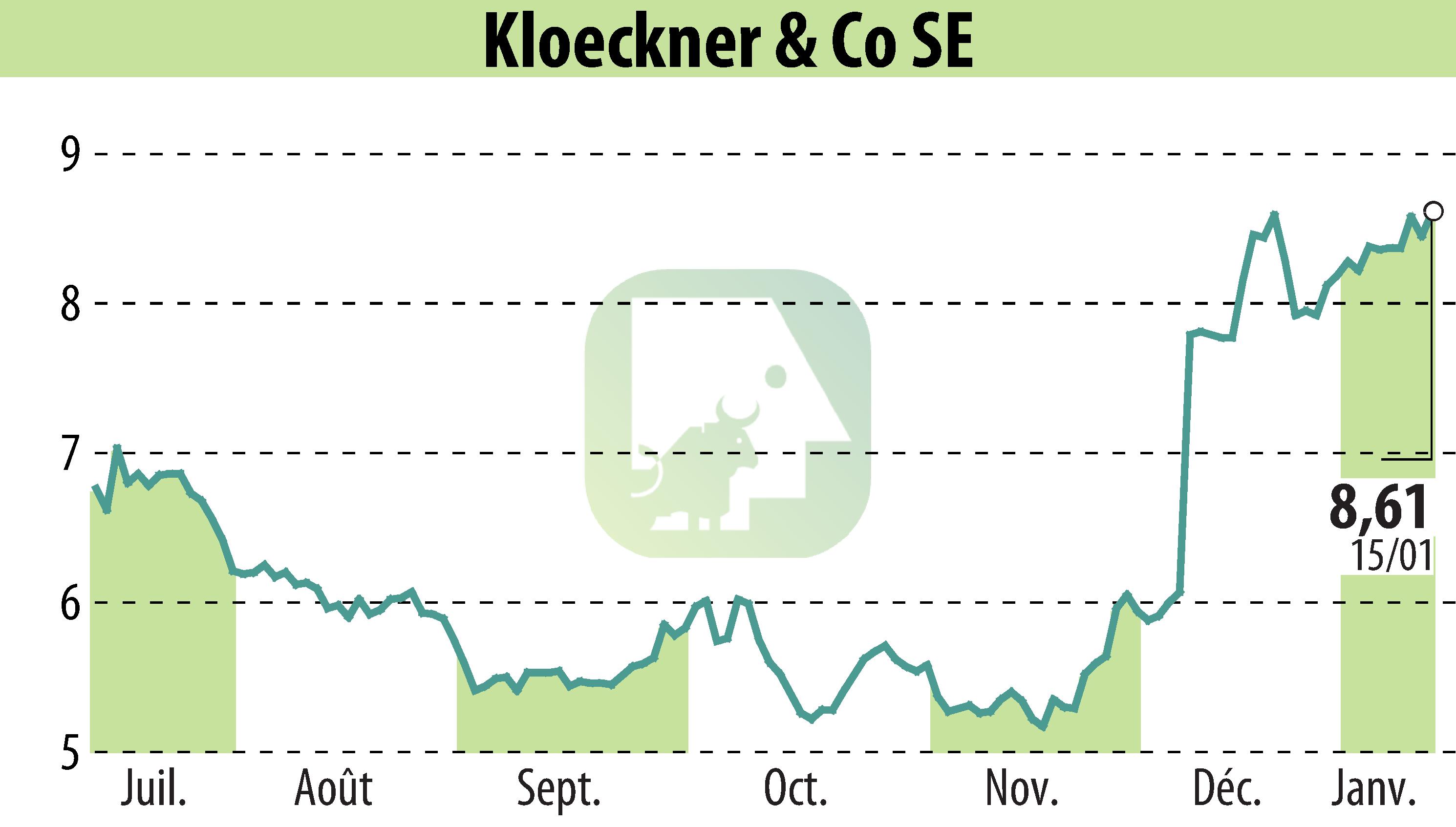

Klöckner & Co SE and Worthington Steel GmbH have signed a business combination agreement, marking a significant step towards a voluntary public takeover offer by Worthington Steel. They propose an attractive offer of €11.00 per share, representing a premium of roughly 98% compared to Klöckner's three-month average share price prior to December 5, 2025. This agreement aims to support Klöckner's strategy of focusing on value-added products and strengthen their market positions in North America and Europe. The completion of the takeover, expected in the second half of 2026, will follow customary regulatory approvals.

The management of Klöckner & Co and Worthington Steel believe this merger will foster sustainable growth and deliver enhanced value to their stakeholders. The European headquarters will remain in Düsseldorf, and the existing Klöckner management will continue to operate independently. While no workforce reductions are planned, the Supervisory Board will include representation from Worthington Steel. The takeover remains subject to a minimum acceptance from 65% of Klöckner's shareholders.

R. E.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de Klöckner & Co. SE