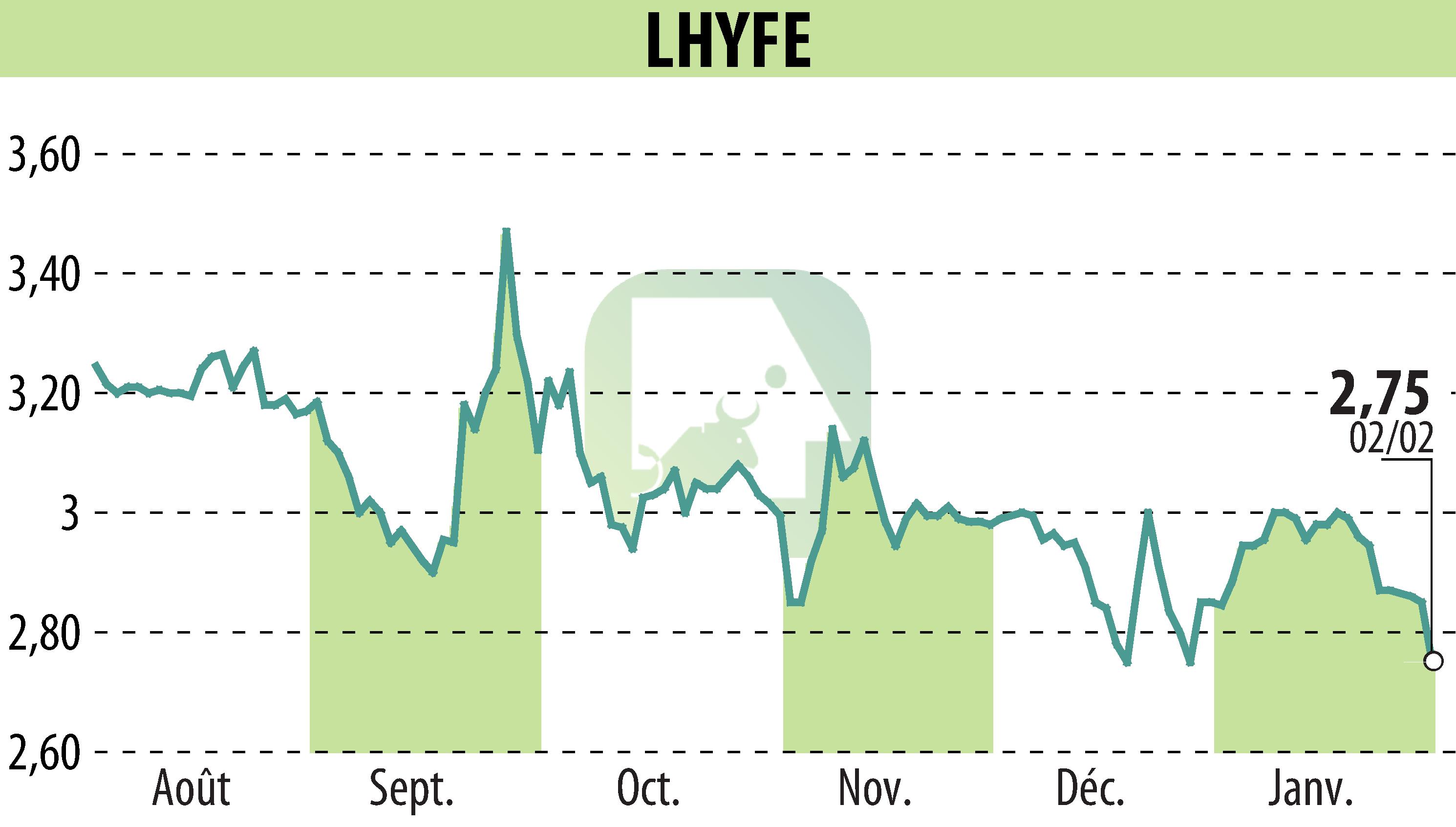

sur LHYFE (EPA:LHYFE)

Lhyfe: 2025 Year in Review and Outlook

Lhyfe doubled its revenue by 2025, reaching €9.8 million. This result is in line with its initial target. The company signed numerous contracts in Europe, expanding its client portfolio to over 55 by 2025. Key agreements include a contract with Hyliko in France and another with a service station operator in Germany.

Deliveries have increased by 80% compared to 2024, reaching 850, primarily in France, Germany, and Sweden. Lhyfe is strengthening its logistics capacity with over 80 hydrogen containers in operation across 9 countries. Construction of sites in France is progressing, aiming for a 70% increase in production capacity.

By 2026, Lhyfe anticipates a 30% cost reduction and will focus on its most mature projects in Europe. Outsourcing of EPC (Engineering, Procurement, and Construction) is being considered to concentrate on its core business. This strategy aims to maintain its dominant position in the green hydrogen market while navigating a complex regulatory environment.

R. E.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de LHYFE