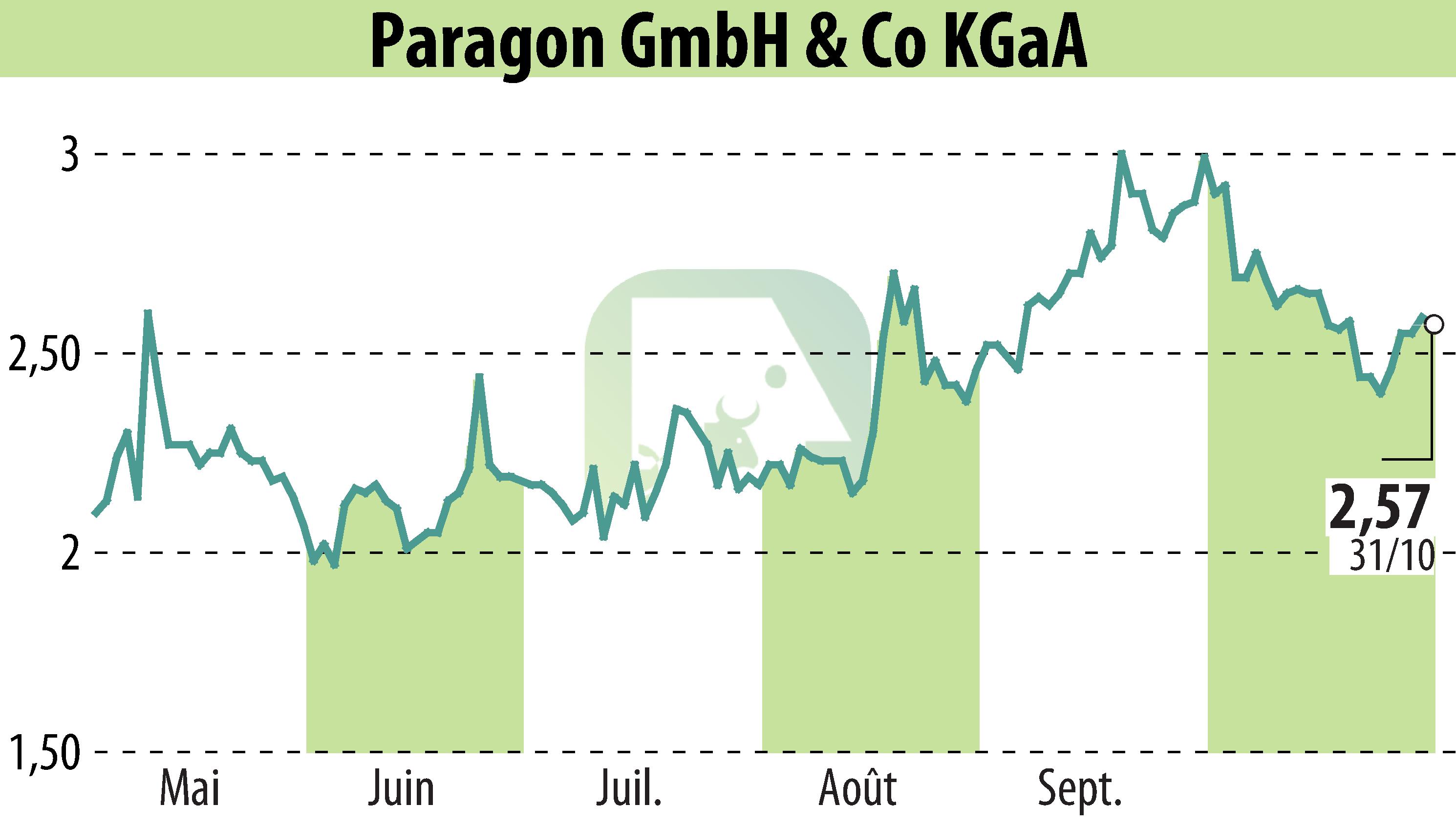

sur Paragon AG (ETR:PGN)

Paragon AG Adjusts Forecast for Automotive Segment

Paragon GmbH & Co. KGaA reports stable third-quarter results despite lower revenues in the automotive segment at €83.4 million. This decline is attributed to the sale of the starter battery business and reduced customer call-offs. Despite these challenges, the company's EBITDA remained stable at €12.5 million, with an increased margin of 15%.

Improvements in business relationships with major clients like Porsche and in Chinese markets contributed to this positive development. Efficiency programs and cost-saving measures have bolstered earnings, prompting an upward revision of the 2025 automotive segment forecast. Paragon now predicts an EBITDA of €19 million based on revenues of €115 to €120 million.

Challenges persist in Paragon's new Consumer Products segment due to distribution delays, yet this does not affect the automotive business. The company is exploring options to refinance a maturing EUR bond by 2027.

R. P.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de Paragon AG