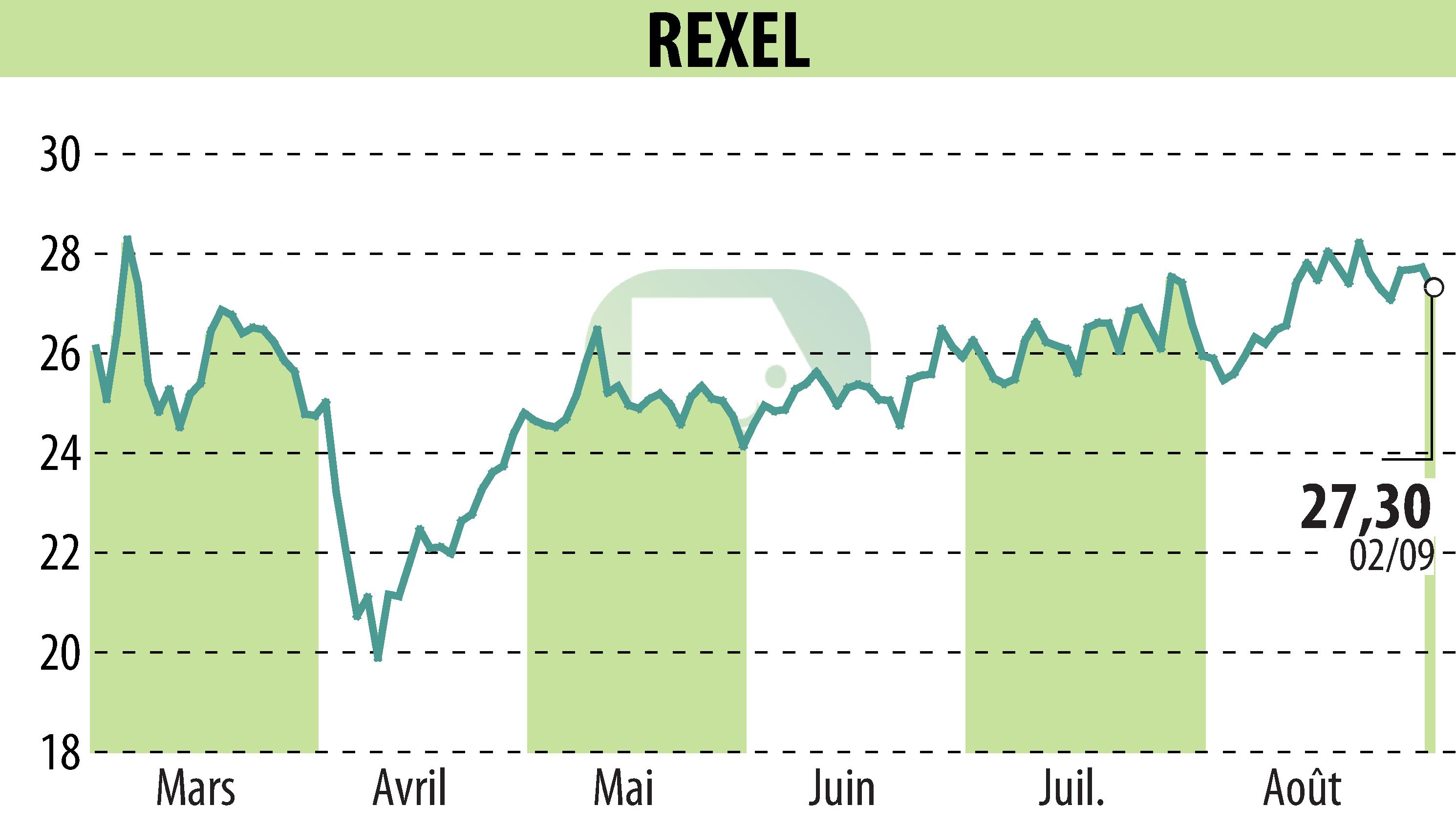

sur REXEL (EPA:RXL)

Rexel Successfully Places €400 Million Senior Notes Offering

Rexel, a leading distributor of energy products and services across multiple channels, has successfully issued €400 million of 4.000% unsecured senior notes due in 2030. The placement aims to enhance Rexel's financial structure by extending its debt maturity profile under favorable conditions. Settlements, as well as the listing of the notes on the Euro MTF market of the Luxembourg Stock Exchange, are anticipated to occur around September 9, 2025.

The notes, maturing on September 15, 2030, will be callable from September 2027 and have been rated Ba1 by Moody’s and BB+ by S&P. Rexel plans to use the proceeds from this issuance for general corporate purposes.

No securities will be publicly offered in France or other jurisdictions, following specific legal frameworks and regulations, including the U.S. Securities Act of 1933, as amended.

R. H.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de REXEL