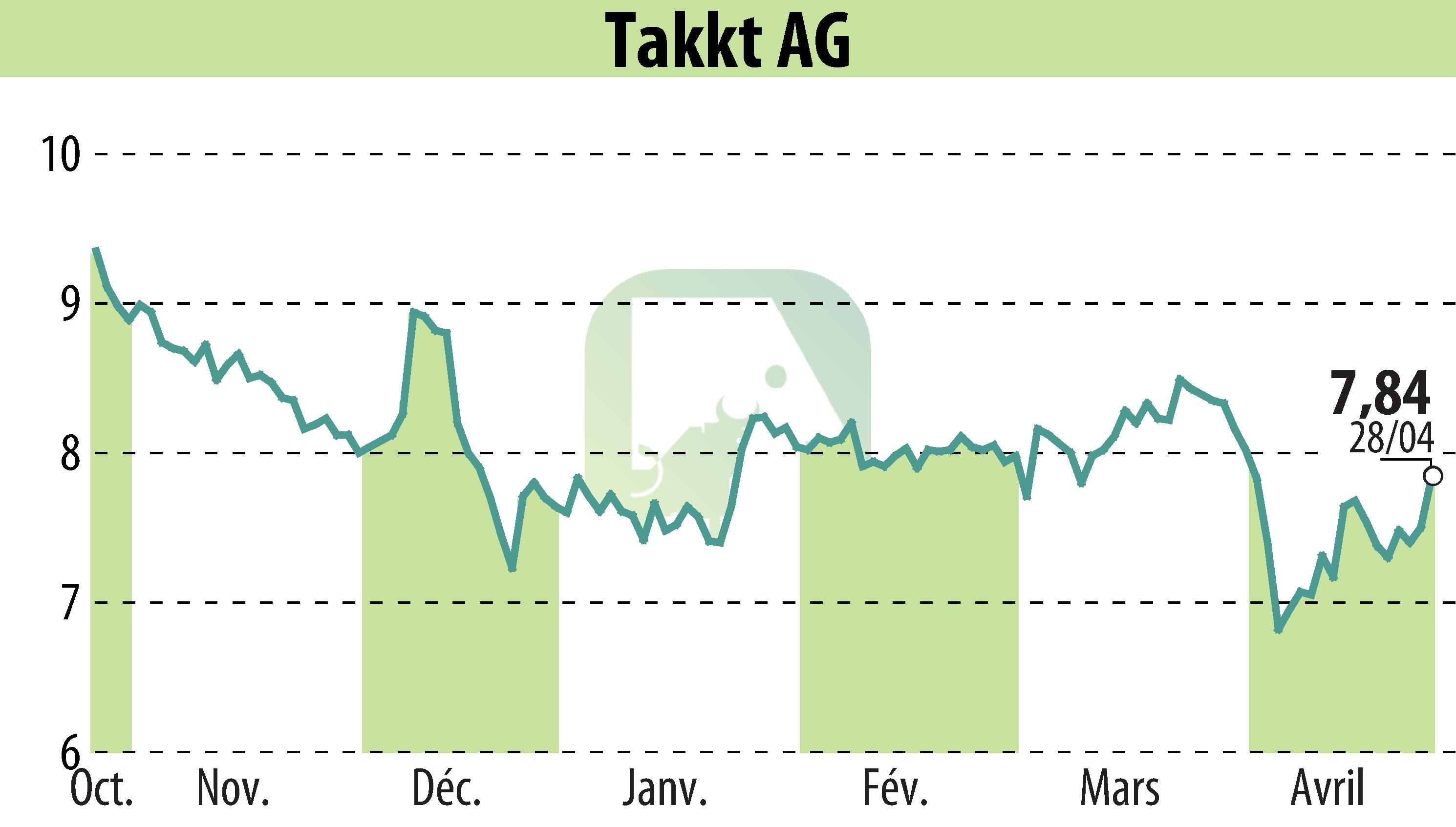

sur TAKKT AG (ETR:TTK)

TAKKT AG: Resilience Amidst Economic Headwinds

TAKKT AG reported a 6.5% decline in sales to EUR 251.5 million for Q1 2025, compared to the previous year. However, the organic sales drop improved from -11.5% in Q4 2024 to -7.6% this quarter. Despite the challenging environment, internal strategic initiatives like “TAKKT Forward” are seeing initial success. CEO Andreas Weishaar highlights ongoing uncertainties due to the US-China trade conflict, impacting customer ordering behavior.

The gross profit margin decreased to 39.8%, influenced by US freight issues. Adjusted EBITDA margin fell to 4.9%. The company is enhancing cash flow through strategic cost measures and inventory investments to ensure delivery capabilities. Free cash flow declined to minus EUR 5.0 million due to reduced EBITDA and changes in inventory management.

TAKKT remains committed to its strategy aimed at growth and profitability, adapting to volatile economic conditions. They anticipate an organic growth between -4% and 6% for 2025. A resolution of the trade disputes could mitigate the economic slowdown impacting customer investments.

R. E.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de TAKKT AG