par Swiss Prime Site AG (isin : CH0008038389)

FY2025: Resilient rental income and record new money in Asset Management ensure stable FFO I of CHF 4.22 per share; higher dividend of CHF 3.50 per share proposed

Swiss Prime Site AG / Key word(s): Annual Results PRESS RELEASE Zug, 5 February 2026

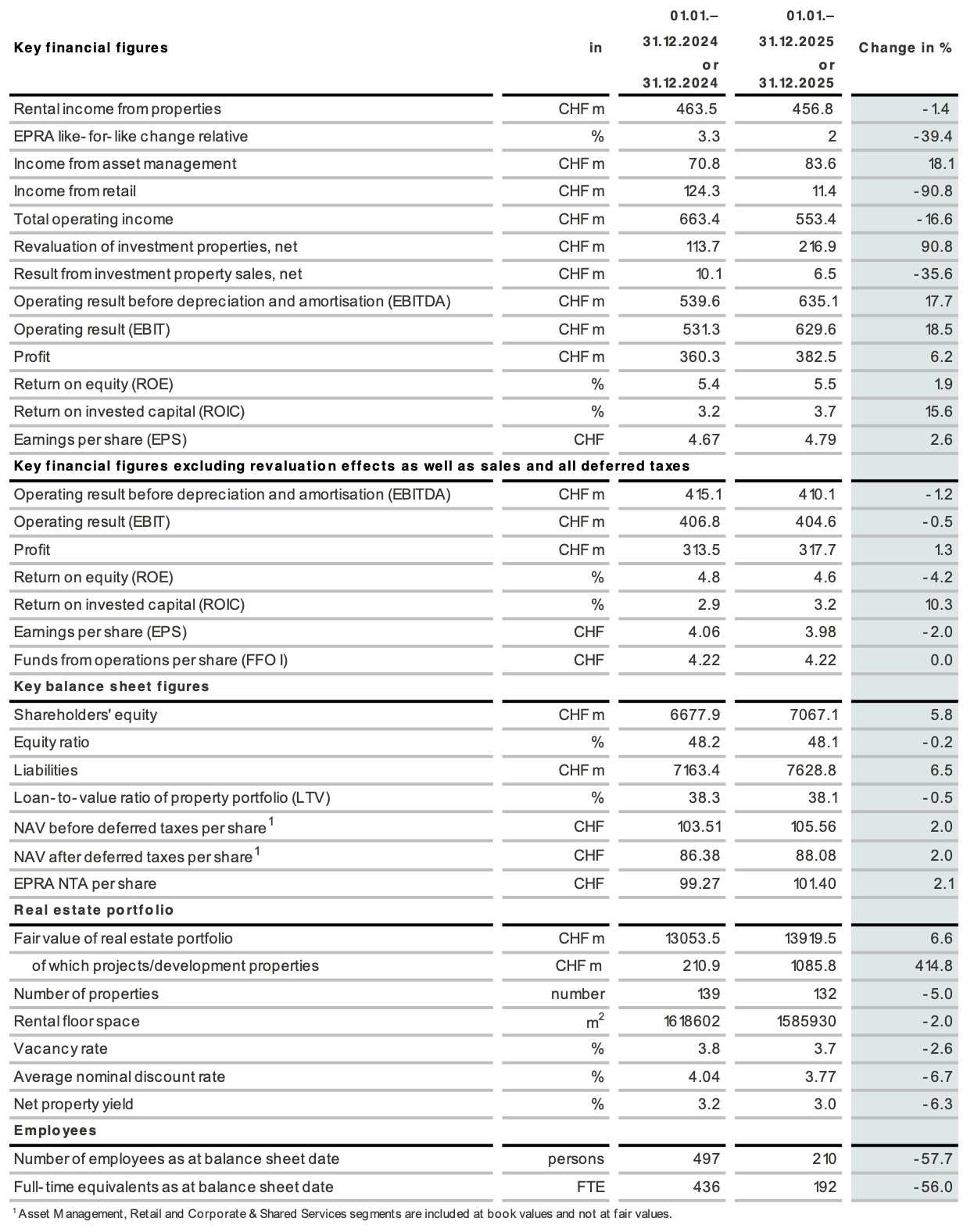

Marcel Kucher, CEO and interim CFO of Swiss Prime Site: “We achieved a strong operating result in the 2025 financial year, with FFO I reaching the same level as in the previous year. It was particularly pleasing that the Real Estate segment proved highly resilient despite the temporary loss of significant rental income due to the renovation of numerous properties. At the same time, we generated record income in Asset Management and attracted more new money than ever before. This strong result shows that our decision to focus on our two core segments − our own real estate and asset management − has proved effective. Having completed our strategic realignment, we are clearly positioned as a pure-play real estate company and we can now exploit market opportunities in an even more targeted manner. For the 2026 financial year, we are therefore very confident that we will be able to exceed our 2025 result, measured by FFO I.” Swiss Prime Site generated Group-level operating income of CHF 553.4 million in the 2025 financial year, compared to CHF 663.4 million in the previous year. This decrease is attributable to the loss of income from Jelmoli’s retail business. Excluding this effect, comparable operating income rose by 2.6% year on year to CHF 537.0 million. Following the elimination of costs related to the retail business and thanks to additional efficiency improvements, operating expenses fell by 42.3% year on year to CHF 148.2 million. Consequently, the operating result (EBITDA), adjusted for revaluation effects (CHF 216.9 million) and contributions from property disposals, was CHF 410.1 million, which corresponds to a decline of 1.2% compared to the previous year. However, on a like-for-like basis, i.e. excluding the impact of the closure of Jelmoli, the operating result (EBITDA) rose by 3.4% year on year. Due to lower financing costs and taxes, total Group profit excluding revaluation effects as well as disposals and deferred taxes rose by 1.3% year on year to CHF 317.7 million. Funds from operations (FFO I) increased by 3.2% year on year to CHF 336.3 million. At CHF 4.22, FFO I per share was unchanged compared to 2024. Swiss Prime Site thus exceeded its guidance range for 2025 of between CHF 4.10 and CHF 4.15 per share. This was due in particular to lower financing costs as well as lower tax expenses. In view of Swiss Prime Site’s strong operational and financial performance, the Board of Directors will propose a CHF 0.05 increase in the dividend to CHF 3.50 per share to the Annual General Meeting on 12 March 2026. Own real estate with resilient top line and higher WAULT of 5.3 years The like-for-like rise in rental income (EPRA LfL) was 2.0%. This increase is mainly attributable to the fact that Swiss Prime Site was able to conclude most of its new rental contracts or lease extensions at more attractive rates. In real terms, EPRA like-for-like rents rose by 1.6% year on year (1.3% from the adjustment of rents and 0.3% from a reduction in vacancies), with indexing accounting for 0.4% of this growth. The vacancy rate was 3.7% as at the end of 2025, compared with 3.8% at the end of 2024, and the weighted average unexpired lease term (WAULT) increased to 5.3 years at the end of 2025 from 4.8 years at the end of 2024. The main drivers of this positive development were the extension of the rental contract with EY at Hardbrücke in Zurich by 10 years and the extensions of rental contracts with Globus at three locations: Geneva (by 10 years), Lausanne (by 8 years) and Lucerne (by 7 years). Value of property portfolio rises with successful allocation of funds from capital increase With the properties that were gradually acquired over the course of the year, Swiss Prime Site fully invested the CHF 300 million of funds (excluding leverage) from the February 2025 capital increase for growth investments. As planned, the funds were invested with a focus on value enhancement. The purchases were focused on the two key Swiss centres of Lake Geneva (Geneva and Lausanne) as well as Zurich. In Zurich, following the acquisition of the SIX Swiss Exchange building in early December, Swiss Prime Site was able to achieve an attractive consolidation of properties on Bahnhofstrasse as part of an asset swap. Overall, it was thus able to acquire properties with a value of around CHF 550 million in 2025. Swiss Prime Site expects these acquisitions to lead to an increase in annual rental income of around CHF 17 million, as planned. As previously announced, the strengthening of the capital base will also allow for a slight reduction in planned property disposals as part of the ongoing capital recycling strategy. For 2026, Swiss Prime Site expects direct and indirect rental income to rise by almost CHF 20 million as a result of the capital increase. As part of the ongoing portfolio optimisation strategy, Swiss Prime Site sold ten properties with a total value of CHF 129.1 million in the 2025 financial year, resulting in a profit of CHF 6.5 million. Taking these sales as well as purchases into account, the total number of properties as at the end of 2025 fell to 132, compared to 139 at the end of 2024. Record result in Asset Management with CHF 1.0 billion inflow of new money Swiss Prime Site Solutions grew in all areas and saw strong investor interest across the entire product range. Due, in particular, to the compelling performance of its investment solutions, it grew faster than the market, reaffirming its position as a leading independent asset manager for real estate solutions. In particular, the successful IPO of the commercial fund SPSS IFC on SIX Swiss Exchange in December 2025 led to the expansion of the product portfolio and diversified its investor base. The fund is now available to all investors. In the 2025 financial year, Asset Management generated operating income of CHF 83.6 million, representing an increase of 18.1% compared to 2024. This strong growth is attributable to the first full-year consolidation of Fundamenta and to higher management fees due to the increase in real estate assets under management, higher transaction-related income from the strong inflow of new money, and increased revenues from consultancy services. Around two-thirds of this revenue is from recurring income, underscoring the high level of stability of Swiss Prime Site’s Asset Management business. The first full-year integration of the Fundamenta Group and strong organic growth generated further significant synergies and economies of scale in the reporting year. Against this backdrop, the operating result (EBITDA) rose by 30.7% to CHF 54.9 million. Strong credit rating, conservative loan-to-value ratio and broad-based financing structure Due to the current low interest rate environment and despite the risk-conscious component of variable liabilities, financing costs fell considerably compared to the previous year. The average interest rate in 2025 was 0.94%, down from 1.10% in the previous year. In the Real Estate segment, the loan-to-value ratio was 38.1% as at the end of 2025, slightly lower than the previous year’s figure of 38.3%. Further progress in reducing the direct carbon footprint Adjusted for weather-related effects, the emissions intensity of the portfolio decreased by 10% to 6.9 kg of CO₂ / m2, which remains well below the linear target pathway to net zero in 2040. In addition, the energy intensity of the real estate portfolio was reduced by around 15% year on year to 139 kWh / m2. The Sustainability Report contains disclosures for significantly more categories of indirect (Scope 3) emissions for the first time, resulting in a substantial increase in transparency. Optimistic outlook for 2026: FFO I of between CHF 4.25 and CHF 4.30 per share expected Swiss Prime Site expects Asset Management to continue on its growth path and is maintaining its forecast of organic growth of around CHF 1.0 billion per year. At the Group level, the operating result is expected to increase considerably in the 2026 financial year. Swiss Prime Site therefore expects FFO I to increase to between CHF 4.25 and CHF 4.30 per share. Despite the current favourable financing environment, it is targeting a stable debt ratio with an LTV of less than 39%. If you have any questions, please contact: SELECTED KEY FIGURES End of Inside Information |

| Language: | English |

| Company: | Swiss Prime Site AG |

| Poststrasse 4a | |

| 6300 Zug | |

| Switzerland | |

| Phone: | +41 (0)58 317 17 17 |

| E-mail: | info@sps.swiss |

| Internet: | www.sps.swiss |

| ISIN: | CH0008038389 |

| Listed: | SIX Swiss Exchange |

| EQS News ID: | 2271738 |

| End of Announcement | EQS News Service |

2271738 05-Feb-2026 CET/CEST